INVESTMENT PORTFOLIO

VISION

To be the company of choice in diversified energy investments in Sub-Saharan Africa

STRATEGIC OBJECTIVES AND INVESTMENT PHILOSOPHY

The overriding objectives of the group are to invest in quality opportunities in the industrial sectors that are aligned to:

•LPG

•LNG

•CNG

•Natural Gas

•Electricity

•Renewables

•Shale Gas

•Fuel

•Coal Bed Methane

•Speciality

•Commodity

•Processing

•Storage

•Manufacturing

•Processing

The investment philosophy adopted is any one of the following:

A controlling equity share with key executives remaining.

A minority share if it is of strategic importance.

A partnership approach as a skilled BEE partner.

Developing new businesses where we have competencies.

Leveraging off Black Industrialists Program Funding where applicable.

Reatile is a long-term investor with no prescribed exit strategy, investing in people to develop the strategy.

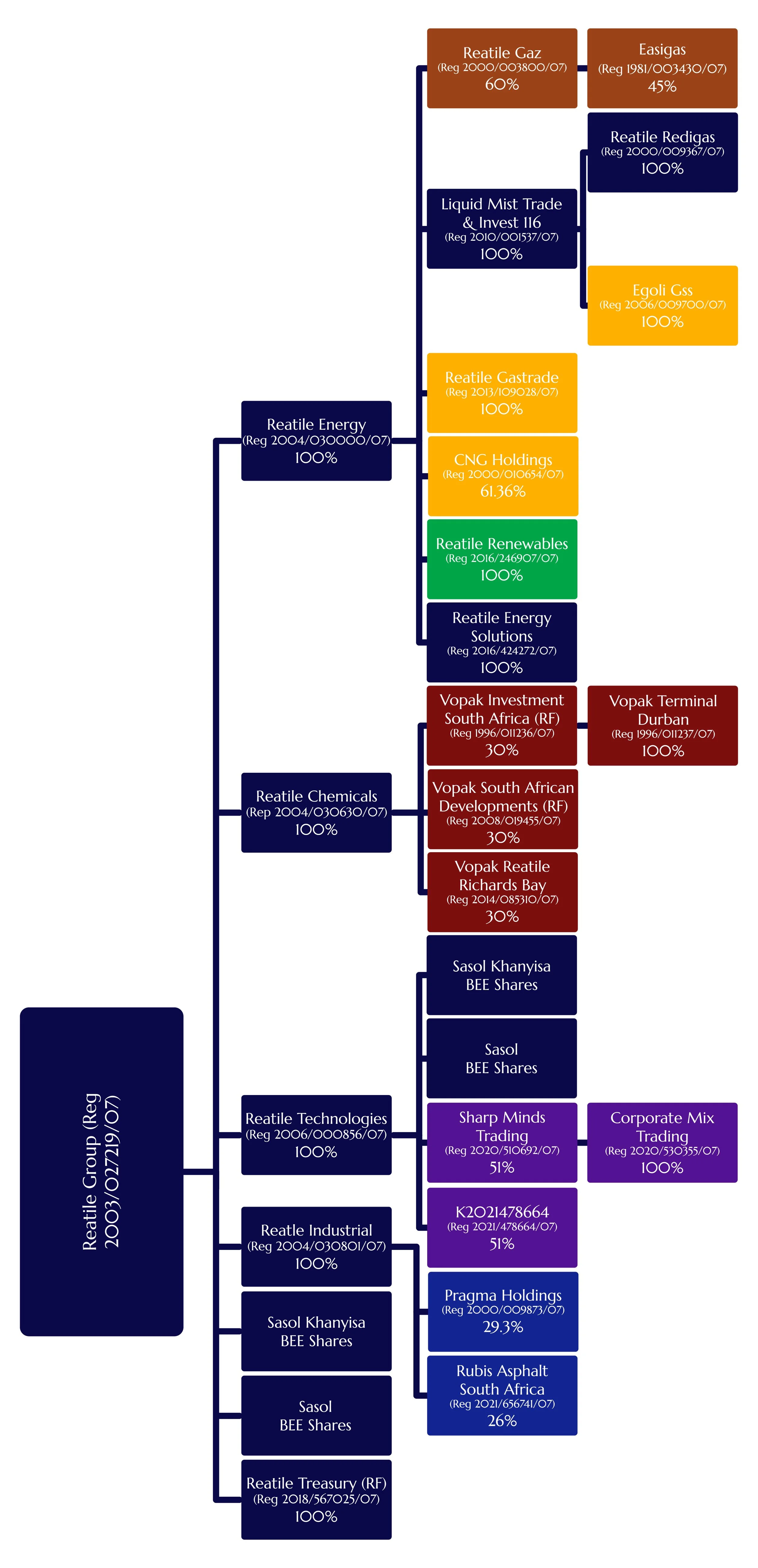

REATILE GROUP SHAREHOLDER STRUCTURE

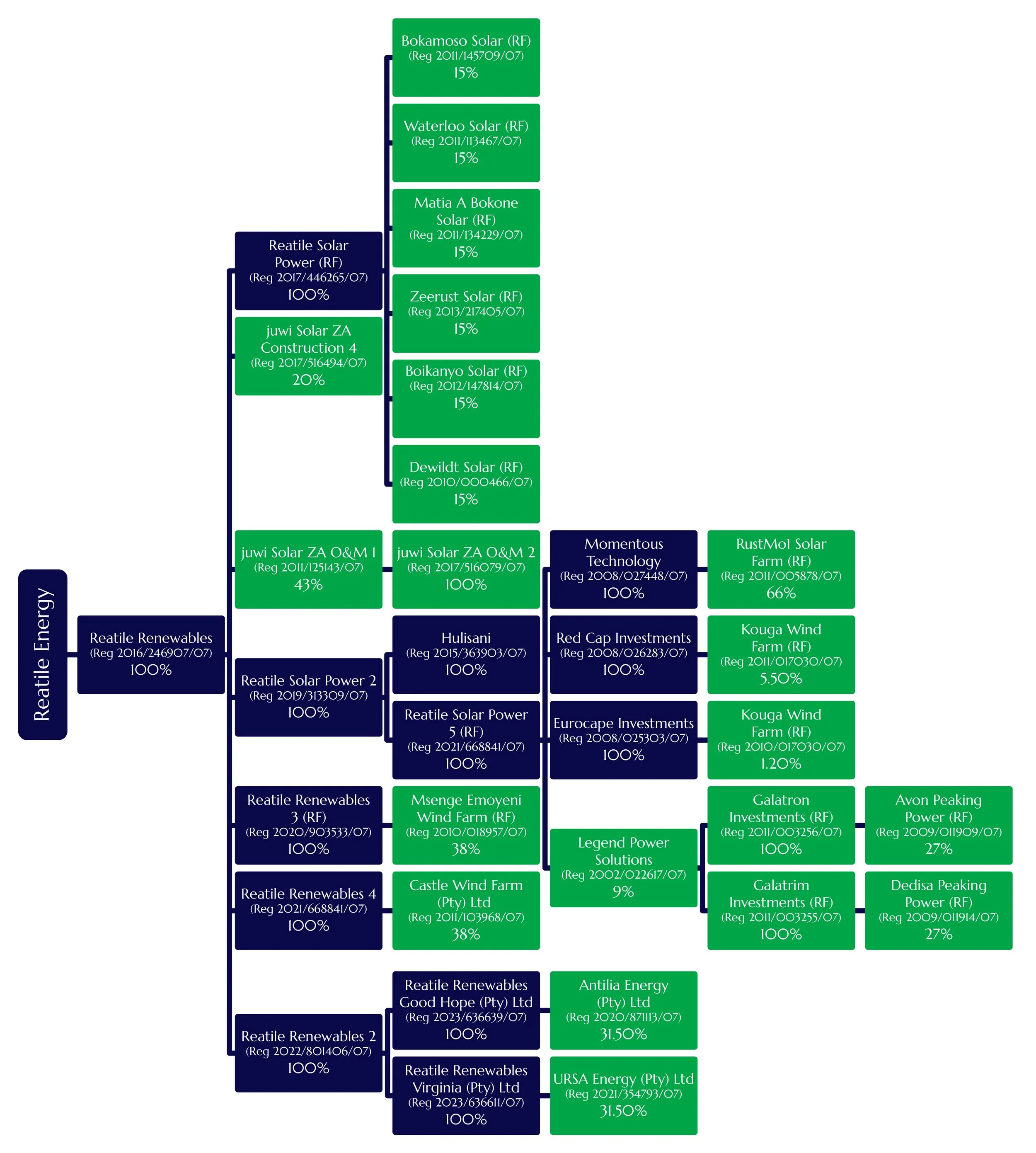

ENERGY PORTFOLIO

The Reatile Group’s vision is to be a leading player across the entire value chain in the Energy Sector and ultimately to be renowned in Sub-Saharan Africa for providing energy solutions in our chosen sectors.

Reatile is currently invested in TRADITIONAL FOSSIL FUELS such as Liquified Petroleum Gas (Easigas) and Natural Gas (Egoli Gas and CNG Holdings), as well as RENEWABLE ENERGY specifically in Solar Power (6 solar photo-voltaic projects in REIPP Round 4 455MW). Future investments in greener alternatives such as Energy Supply Services, Upstream Equity Investments (MRDP), and Equity Participation in national G2P are being targeted.

-

Egoli Gas (Pty) Ltd is 100% owned by Liquid Mist which is 100% owned by Reatile Energy.

-

Easigas is owned 55% by Rubis and 45% by Reatile Gaz.

-

Reatile Energy purchased 61.36% of the equity of CNG Holdings (Pty) Ltd.

-

Acquisition of 20% interest in juwi Solar ZA Construction and 43% interest in juwi Solar ZA O&M.

-

Reatile is one of Sasol (Ltd) selected BEE partners as part of its Sasol Khanyisa share scheme.

-

Reatile Solar Power acquired 15% equity stake in Matla A Bokone.

-

Reatile Solar Power acquired a 15% equity stake in Zolograph Investments(RF) (Dewildt) (50MW).

-

Reatile Solar Power acquired a 15% equity stake in Bokamoso Energy(RF) (67.9MW).

-

Reatile Solar Power acquired a 15% equity stake in Greefspan PV Power Plant (55MW).

-

Reatile Solar Power acquired a 15% equity stake in RE Capital 2(RF) (Zeerust) (75MW).

-

Reatile Solar Power acquired a 15% equity stake in DPS79 Solar Energy (Waterloo) (75MW).

-

Reatile Renewables acquired 100% of the issued ordinary shares in the share capital of Hulisani Limited.

-

Avon and Dedisa are South Africa's first large privately owned power generating plants.

-

This plant forms part of the REIPPP Bid Window 1. Based in the Eastern Cape province.

-

This plant forms part of the REIPPP Bid Window 1. Based in the North West province.

CHEMICAL AND PETROLEUM PORTFOLIO

The Reatile Group’s strategy is to operate across the value chain in the petroleum industry and ultimately to acquire a Strategic Equity Investment in a Refinery & Distribution Network in South Africa to be an integrated Petroleum Company operating in Africa.

Reatile is currently invested in storage (VOPAK) and is looking to partner with companies on distribution and retail as future investments.

-

Vopak is the world's largest independent tank storage provider.

INDUSTRIAL PORTFOLIO

Reatile Group is currently invested in asset management for the industrial, manufacturing, oil & gas, and energy sectors.

-

Vopak is the world's largest independent tank storage provider.

-

Rubis Asphalt South Africa is a specialised importer and distributor of bitumen.

STRATEGIC PARTNERS

-

RMB is Reatile Group's main funding partner and a refinancing deal of R1.5bn was concluded in 2022.

-

The IDC is a 38.64% shareholding in CNG Holdings, in which Reatile Energy (Pty) Ltd owns 25.01%.

-

Engen Petroleum Limited is a 40% shareholder in Reatile Gaz (Pty) Limited (since 2006).

-

Easigas (Pty) Ltd is owned 55% by Rubis Energie SAS (France) and 45% by Reatile Gaz (Pty) Ltd.

-

Moore was appointed as Corporate Financial Advisor to Reatile in 2021.

-

Reatile Group is a proud member of the South African Photovoltaic Association.

-

Reatile Group is member of the Energy Council of South Africa.

-

The Standard Bank of South Africa is a funding partner to Reatile Group.

-

Nedbank is a funding partner to Reatile Group.

WHAT’S IN A NAME

Our company’s official name is REATILE. It is a Tswana name meaning “WE HAVE GROWN” or more suitably in our case, “WE ARE GROWING”.